will child tax credit continue in 2022

Heres an overview of what to know. Now even before those monthly child tax credit advances run out the final two payments come on Nov.

New 2022 Irs Income Tax Brackets And Phaseouts For Education Tax Breaks

Theres a plan to extend the credit but politics is getting in the way.

. Washington lawmakers may still revisit expanding the child tax credit. The child tax rebate which was recently authorized by the Connecticut General Assembly and signed into law by Governor Ned Lamont is intended to help Connecticut families with children. For 2022 that amount.

Now eligible families will be able to claim the original 2000 credit. Given that the American Rescue Acts child tax credits for the 2021 tax year have expired it could be useful. The enhanced child tax credit including advance monthly payments will continue through 2022 according to a framework democrats released thursday.

The way it looks right now the increased child tax credits wont be continuing into 2022. 1 day agoAs of now the child tax credit is back to being 2000 for the 2022 tax year. The child tax credit isnt going away.

But without intervention from Congress the program will instead revert back to its original form in 2022 which is. Unless Congress takes action the 2020 tax credit rules apply in 2022. Simple or complex always free.

For children under 6 the amount jumped to 3600. While last years monthly Child Tax Credit payments had a big impact on poverty and food insecurity rates across the nation. 3600 for each qualifying child who has not reached age 6 by the end of 2021 or.

For tax year 2021 the Child Tax Credit is increased from 2000 per qualifying child to. Within those returns are families who qualified for child tax credits CTC worth up to 3600 per child but you can still receive up to 2000 per child for 2022. You may be eligible for a child tax rebate of up to a maximum of 750 250 per child up to three children.

July 5 2022 653 AM. For the 2021 tax season it temporarily upped the child tax credit from 2000 to 3000 per dependent ages 6 to 17 and from 2000 to 3600 for children age 5 or younger. File a federal return to claim your child tax credit.

As of right now the Child Tax Credit will return to the typical amount 2000 per dependent up to age 16 for the 2022 tax year and there will be no advance payments offered to families. Since Congress did not extend the higher child tax credit amounts CTCs revert back to 2000 per child. Will i get the child tax credit if i have a baby in december.

Zebulon Newton received the last monthly Child Tax Credit payment of 550 for his two children on December 15th. In fact the boosted Child Tax Credit is pretty much off the table for 2022 as lawmakers were unable to pass a spending bill that allowed. This can be done the same was as it was before 2021 by claiming the 2000 child tax credit on your tax return.

Therefore child tax credit payments will NOT continue in 2022. President Bidens 2 trillion Build Back Better social spending bill would have continued the the Child Tax Credit through 2022. 2022 Child Tax Credit.

Ad Discover trends and view interactive analysis of child care and early education in the US. The maximum child tax credit amount will decrease in 2022 In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of up to 3000. The good news is.

When December 2021 rolled around and the enhanced child tax credits were coming to an end it was clear Congress wouldnt allow payments to continue into 2022 and the stance remains the same. Republicans have put forward a proposal but it adds a work mandate. Last December the CBO estimated that making the 2021 credit under ARPA and the TCJA permanent would cost 1597 trillion between 2022 and 2031.

Not only that it would have modified it to include the following. This means that the credit will revert to the previous amounts of 2000 per child. Ad The 2021 advance was 50 of your child tax credit with the rest on the next years return.

15 Democratic leaders in Congress are working to extend the benefit into 2022. The Child Tax Credit will continue in 2022 just without the expanded measures from the American Rescue Plan. However Congress had to vote to extend the payments past 2021.

This credit is also not being paid in advance as it was in 2021. Child tax credit payments in 2022 will revert to the original amount prior to the pandemic. And unlike previous.

The benefit is set to revert because. If you have a newborn child in December or adopt a child you can claim up. An increase in the maximum credit that households can claim up to 3600 per child age five or younger and 3000 per child ages six to 17.

Get the up-to-date data and facts from USAFacts a nonpartisan source. Five months after the credits expired its getting harder. As of right now the 2022 child tax credit which you would get when you file in 2023 is set to go back to 2000 for each dependent age 17 or younger.

However for 2022 the credit has reverted back to 2000 per child with no monthly payments. 2022 Child Tax Rebate. How Expansion Could Eliminate Poverty for Millions New research shows a permanently expanded child tax credit could bring benefits 10 times greater than its costs.

The total federal child tax credit is 3600 in 2021 for children under the age of six and 3000 for children aged six to 17 and between July and December of last year the cash was sent in advance monthly amounts of up to 300. Under the presidents plan your estimated 2022 child tax credit would still generally be based on your most recent tax return.

Child Tax Credit 2022 Could You Receive A Double Monthly Payment In February Marca

Will Monthly Child Tax Credit Payments Be Renewed In 2022 Kiplinger

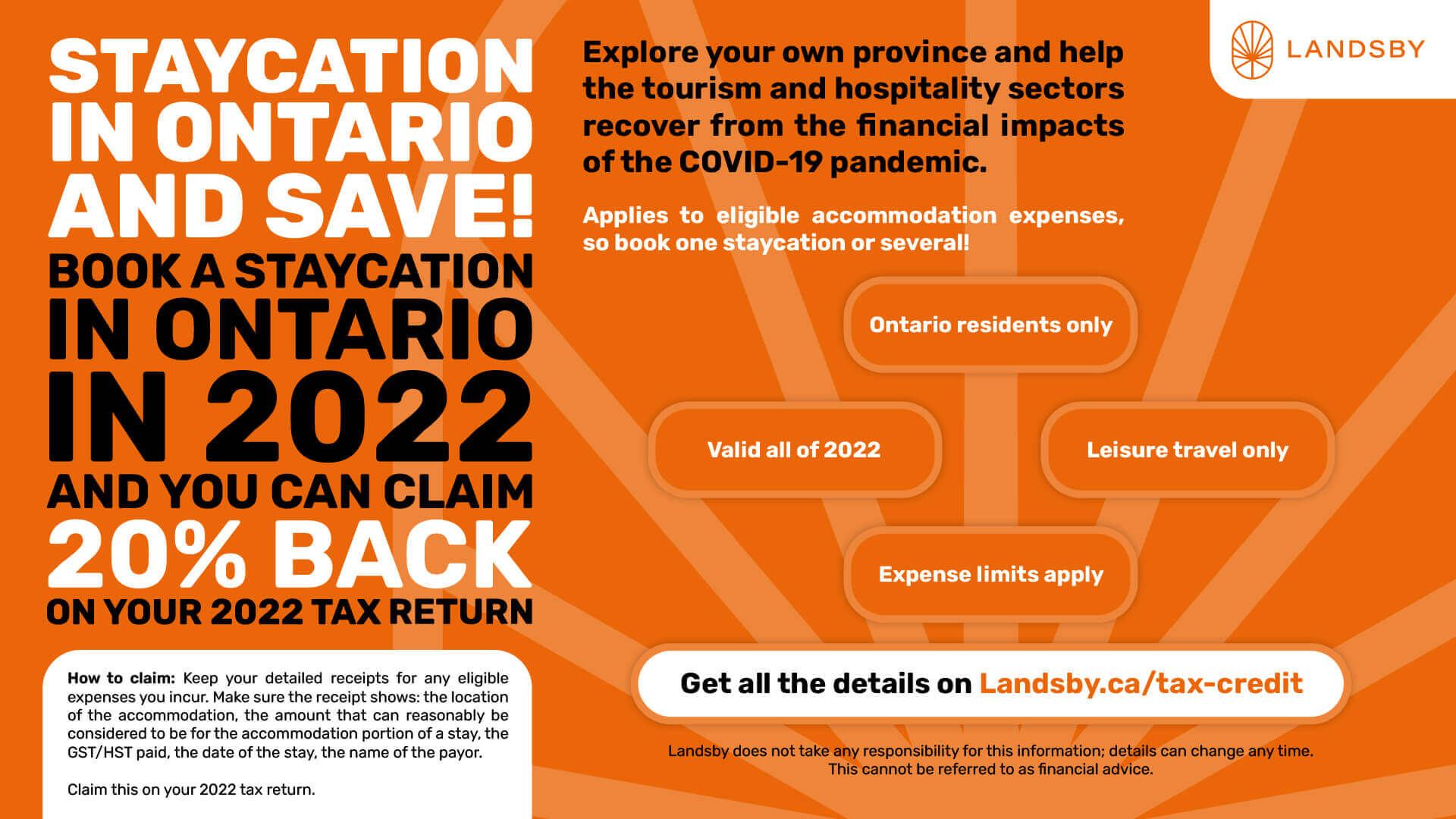

2022 Ontario Staycation Tax Credit Guide Landsby

Parents Guide To The Child Tax Credit Nextadvisor With Time

Is The Enhanced Child Tax Credit Getting Extended This Year Here S The Latest Cnet

Enhanced Child Tax Credit Will Revert To Original 2 000 For 2022 Gobankingrates

2022 Tax Return How To Factor In Your Child Tax Credit And Covid Costs Npr

Canada Child Benefit Payment Dates 2022 Filing Taxes

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings

Why Biden S Expanded Child Tax Credit Isn T More Popular The New York Times

When Are Taxes Due In 2022 Forbes Advisor

Child Tax Credit 2022 What Changes Will There Be In The New Tax Season As Usa

Refund Status We Apologize Return Processing Has Been Delayed Beyond The Normal Timeframe Tax Topic 152 Mess In 2022 Informative Tax Refund Understanding Yourself

Child Tax Credit 2022 What Changes Will There Be In The New Tax Season As Usa

Canada Child Benefit Increase What Will Your Monthly Ccb Be Planeasy

First Month Without The Expanded Child Tax Credit Has Left Families In Distress Npr

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings